DeFi Deep Dive 1: Unit Protocol

A Weekly Series Profiling Protocols Featured on DeFi Llama

🦙 DeFi Llama tracks over a hundred protocols. How well do you know them all? Each week our staff of llamas perform a deep dive on one of the protocols🦙

Unit Protocol has captured our attention with its consistent growth rate and captured our hearts with its adorable pink duck logo.

The protocol is a decentralized borrowing platform with the capability of collateralizing a wide variety of assets to mint their native dollarcoin $USDP. This fills a useful role in DeFi. Per their docs:

“Many crypto holders own a diversified portfolio of assets, including a variety of capitalized and under-capitalized tokens. Popular liquid assets are easily sold on exchanges and holders can access instant liquidity without the need to borrow. However, less liquid assets are difficult to sell quickly, yet they represent a significant measure of value in the crypto asset world. Right now there is no way to borrow liquidity for such assets. It limits DeFi applications, funding, and usability.”

Their assessment of DeFi has clearly filled a niche. $USDP has grown nearly 500% in the past month, reaching 14th on CoinGecko’s ranking of stablecoins

This has quickly netted USDP a market cap over $100MM .

Impressively, it’s achieved this volume while trading on only two exchanges. The primary destination to mint USDP is on its pale mauve homepage at https://unit.xyz/. They also operate a portal on BSC.

As of publication they support 50 assets in addition to a cavalcade of Uniswap and Sushiswap pools.

What does this mean exactly? Let’s walk through an example.

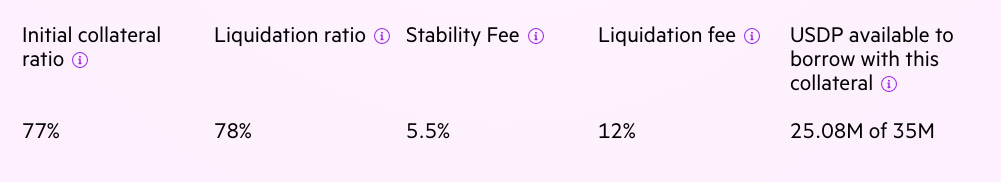

Consider if you wanted to take out a loan on 1 ETH as an example. Unit Protocol currently offers the following rates:

The initial collateral ratio is the most you can take out against your 1 ETH. At today’s price of about $1800 that means you can at most take out $1386.

Borrowing a higher amount is riskier though, due to the liquidation ratio. If your debt/collateral ratio exceeds this rate, your position may be liquidated. In other words, if you borrow at the 77% and your position adjusts to 78% (ie your $1386 debt increased to $1404) then your loan is subject to liquidation.

This can happen due to the “stability fee,” the cost of USDP debt per year. If nothing else changes, your $1386 debt becomes $1462 by the end of the year. If the price of ETH stays constant, you’ll be in liquidation territory within three months.

If any account is subject to liquidation, the collateral is put up for a Dutch auction at a price that decreases linearly by time. Anybody can trigger a liquidation directly via the smart contract interface, and the Unit Protocol team have a bot that also manages the process. Available auctions are notified on their telegram channel and available auctions are listed on their liquidation subdomain.

All DeFi users should keep a close eye on Unit Protocol. With so many DeFi offerings, clever traders may find opportunity for profit: