🦙 DeFi Llama tracks over a hundred protocols. How well do you know them all? Each week our staff of llamas perform a deep dive on one of the protocols🦙

Those of you who made it through first year calculus will immediately identify the platform as a derivative. They prefer to brand their offering as “Decentralized Leverage.” They allow trading perpetual contracts, margin trading, spot trading, lending and borrowing and allow up to to 25x leverage. The leverage slider is a prominent feature of their platform.

The protocol offers perpetuals on a wide variety of assets and DeFi tokens. They are innovating rapidly, adding new assets frequently. They currently list support for at least 22 popular tokens on their homepage.

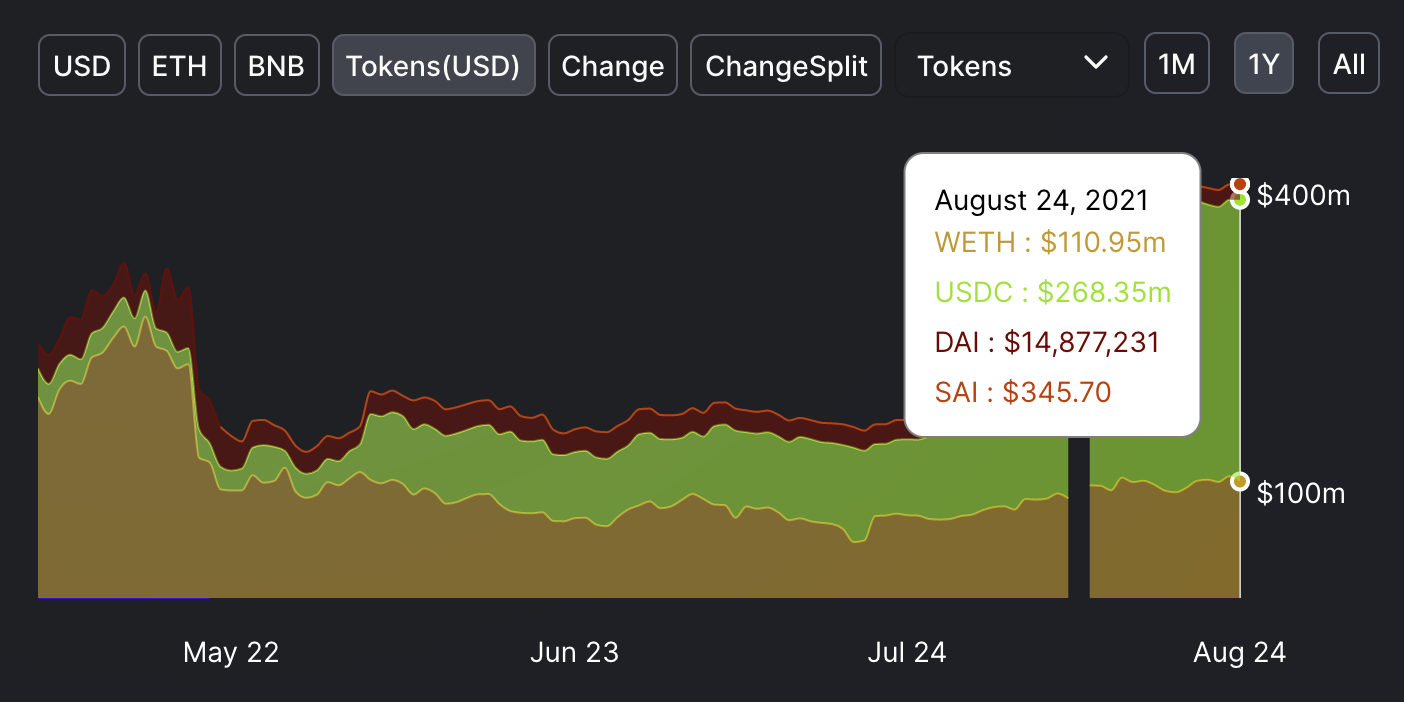

Over the past year they’ve seen their volume locked jump from under $30MM to nearly $400MM, mostly on the back of USDC. They also boast over $5 billion traded since launch.

A look at their recent volume suggests users of the protocol have been very active lately, particularly from their 7.5K weekly active users.

The team is also just as busy. They built and launched an L2 on StarkWare, utilizing ZK-Rollups for fast and cheap trades. Several of their fees are variable and have volume discounts, currently from 0.00%-0.05% on the maker side to 0.06% to 0.10% on the taker side on their L2 network, with fees edging toward 0.20% on L1.

Despite these relatively low fees, they are still managing to bank major revenue.

This must surely please their investors. They boast of backing by a who’s who of name VCs.

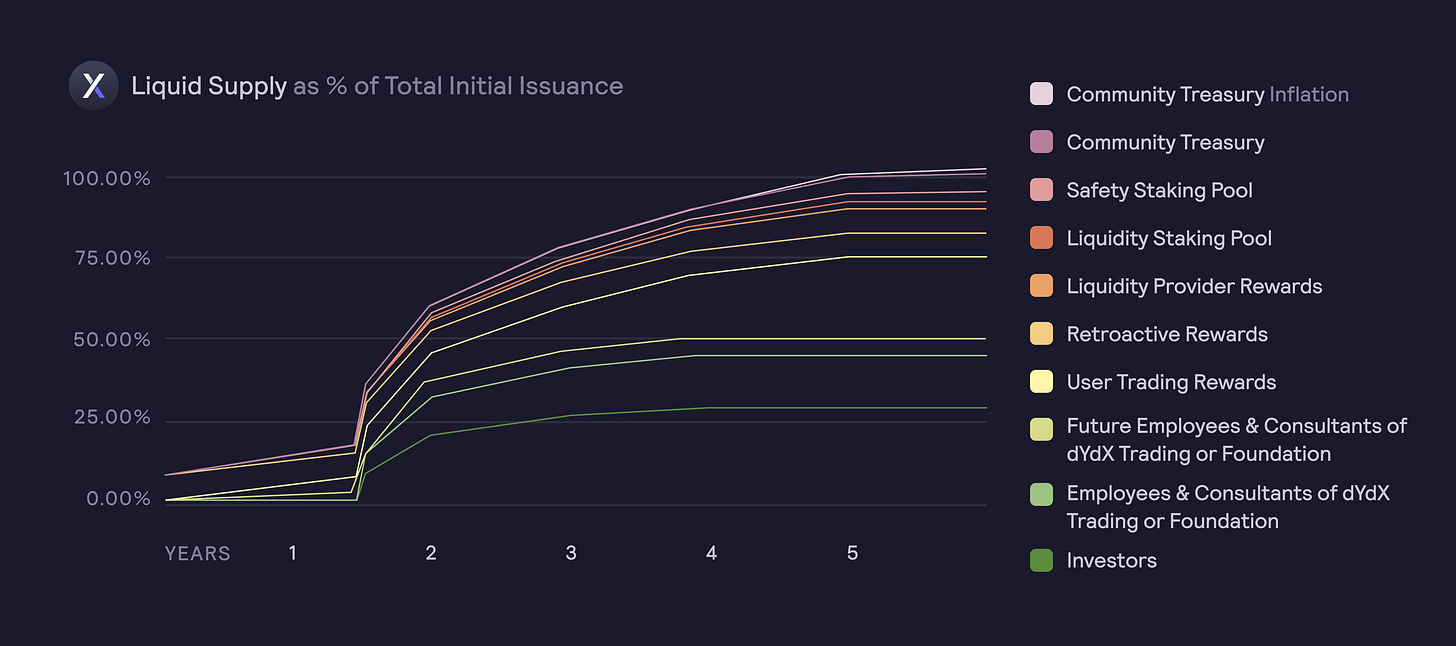

Although they claim to be a decentralized exchange, their Perpetual services are unavailable to Americans, so the specifics of their decentralization are a bit unclear. They have taken some notable steps towards decentralization, including launching a dYdX Foundation based in Switzerland. At the same time they launched a straightforward governance token $dYdX to reward their early users.

The token airdrop started on August 3rd for performing various actions around dYdX, with tokens becoming transferable on September 8th. The airdrop is ongoing as of publication, and their new token is not presently tracked on CoinGecko.

If you’re interested in learning more about dYdX, check out their GitHub, Twitter, Discord, or website.

Would you like us to profile any of the protocols listed on DeFi Llama? Send us a note in the comments!

With regards to the DEX vs no Americans allowed issue. I assume its like Uniswap? permissionless contracts, permissioned interface?