🦙 DeFi Llama tracks over a hundred protocols. How well do you know them all? Each week our staff of llamas perform a deep dive on one of the protocols🦙

For millenia alchemists dreamed of turning ordinary materials into gold. Alchemix has perhaps found the solution: loans that repay themselves.

Alchemix allows you to take out a loan that will never be liquidated. They offer loans that automatically repay themselves over time, ensuring you never need to lose your collateral.

They can do this thanks to the emergence of yield farming aggregators like Yearn. Nowadays it’s ridiculously easy to reliably earn a yield on stablecoins within DeFi. Alchemix’s framework puts your collateral to work earning yield, and applies this yield toward repaying your loan. You can exit early, or just sit around and wait for the loan to repay itself.

Minds are being blown as users start to understand the concept. Here are a pair of thoughtful threads describing the implications:

All of this allows for innovative trading strategies:

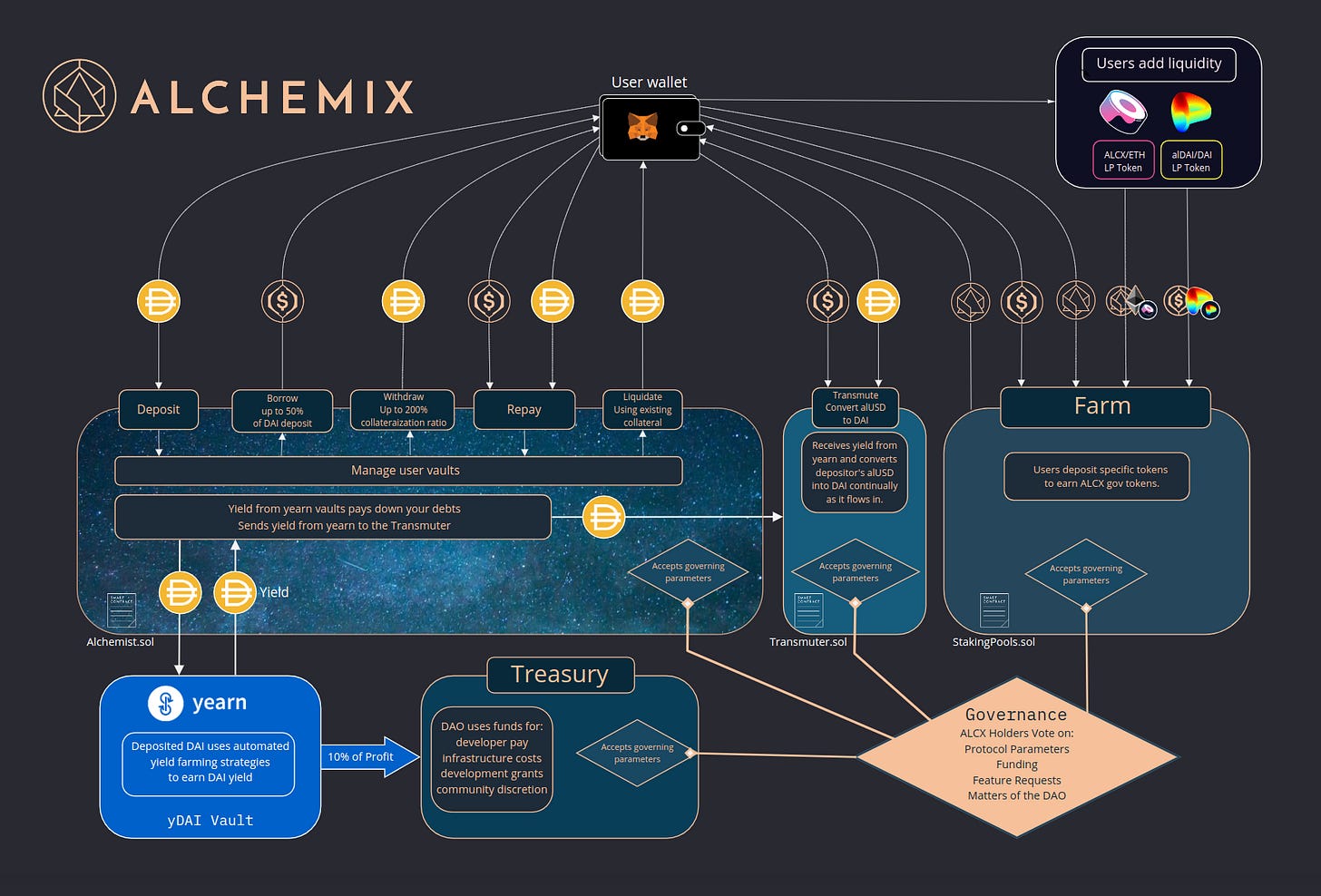

As described in the white paper, the Alchemix ecosystem is beautifully structured into four main components: Vaults, Transmuter, Farming, and Treasury:

Vaults cover the yield advance. Users can deposit DAI (and eventually others), and receive up to 50% of the DAI back in the form of alUSD that is fungible as a dollar. Alchemix deposits the DAI into Yearn and earns yield, which goes into repaying the loan. Whenever users have a positive balance they can withdraw DAI or mint USD at their discretion. There’s never any risk of the collateral being automatically liquidated, although users have options for voluntarily liquidating their position if they don’t wish to have their funds locked.

Transmuter is responsible for collecting yield generated by all deposits into the system. Users can stake alUSD into transmuter, which acts like a bond to mature into DAI. Although this portion is operation is automated, it does require users to actively make sure their position does not overflow. If a 1000 alUSD position filled to 1050 DAI, other stakers can jump in and claim the surplus.

Farming allows users to earn the ALCX token which provides governance rights and potential future utility. The ALCX token emission is planned to decrease linearly from 22,344 to 2,200 per week, to provide full clarity upfront about the inflation schedule.

Treasury processes the yield, maturing positions in the Vault and sending them to Transmuter. 10% of this is passed to the DAO for further development, the direction of which is dictated by vote of ALCX holders.

The friendly Alchemix offering has generated incredible growth. In a month the protocol has already accumulated nearly a billion dollars in value locked. Have fun transmuting your money!